📈 Inflation

The Silent Wealth Eroder 💸📉

Ever heard of the Australian Bureau of Statistics (ABS)? They’re the data wizards tasked with tracking all sorts of economic metrics, including one that’s a real wallet wrecker: inflation. 📊💰Here’s the scoop: ABS keeps tabs on everyday essentials like bread, milk, petrol, and even house prices. They crunch the numbers, sprinkle in some magic formula, and voila—out pops the average inflation rate, a sneaky little figure that can wreak havoc on your finances. 😬

But here’s where things get interesting. The government takes this inflation figure and uses it to make decisions that impact your life, like setting interest rates or adjusting pension payouts to keep up with rising costs. It’s a ripple effect that can send shockwaves through your wallet. 🌊💼

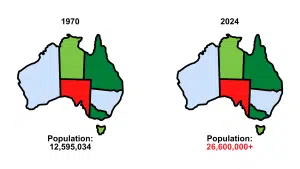

Now, let’s take a stroll down memory lane and peek at how inflation has been playing the market over the past six decades. Strap in, folks—it’s a bumpy ride! 🎢💸

- 1950s-1960s: Inflation was a mere blip on the radar, hovering around 2-3%. Life was good, and so were the prices.

1970s: Cue the disco era and soaring inflation rates. Prices were skyrocketing, hitting double digits and leaving wallets feeling the pinch.

1980s: A glimmer of hope as inflation started to cool off, but still hanging around the 5-6% mark. Tighten those purse strings!

1990s: The economy hit its stride, and inflation took a nosedive, dipping below 2%. Cue collective sighs of relief.

2000s: The new millennium brought with it steady inflation rates, hovering around 2-3%. Smooth sailing…for now.

2010s: Inflation remained relatively stable, with minor fluctuations but nothing too alarming. Phew!

2020s: And here we are, navigating the choppy waters of uncertainty, with inflation rates bouncing around like a yo-yo. Hang on tight, folks—it’s a wild ride!

So, what’s the takeaway from all this? Inflation is no joke, folks. It’s the silent wealth eroder, slowly chipping away at your purchasing power and leaving you feeling the pinch. But fear not—knowledge is power. Stay tuned as we unpack strategies to beat inflation at its own game and keep your financial ship afloat. 🚢💡

Ready to outsmart inflation and secure your financial future? Register now to learn more about property investment and start your journey today! 🌟

“See you on the other side!”🫡

Daimien Patterson

Email 135: – by Monica

Heading: 🌟The answer to true wealth

Subheading: Property Investment🏠

Hey there,

Let’s talk about Sally the super-saver. We all know someone like her, right? She scrimps, saves, and pinches pennies until she can finally afford that shiny new car—paid for in cash, no less. Admirable? Sure. Smart? Not so much. 🚗💸

Why? Because here’s the truth: Saving alone won’t make you wealthy. Nope, not even close. You see, Sally’s car? It’s a depreciating asset—a cash flow liability that drains her wallet with every trip to the pump or visit to the mechanic. 🤯

So, let’s flip the script. Instead of squeezing every penny until it squeals, let’s talk about investing. And not just any investment—real assets that grow in value and generate passive income. 💰📈

But before we dive in, let’s run a little thought experiment, shall we? I call it the Tight-Arse Challenge. Here’s how it goes:

Imagine scrimping and saving for a whole year—no going out, no holidays, nothing. How much could you save?

Now, picture living that way for 10 years. How much could you save in that time?

And finally, envision retiring on those savings. How long could you make them last?

Here’s the kicker: You can’t save your way to wealth. Nope, not gonna happen. Because the moment you stop working, your savings dry up, and you’re left high and dry. 💸🛑

But fear not, my friend. There’s a better way, a way that leads to true financial freedom. It starts with investing in real assets that appreciate over time and generate passive income, like property. 🏠💡

So, what are you waiting for? It’s time to shift your focus from saving to investing. And trust me, your future self will thank you for it. Ready to take the plunge? Let’s chat about how property investment can pave the way to the life of your dreams. 🚀

Don’t wait to secure your financial future. Register now to learn more about property investment and start your journey today!

“See you on the other side!”🫡

Daimien Patterson