Decoding the tax puzzle

A simple guide🤔

I often ask my clients if they know how the tax system works. At first, they usually say yes. So we ask them a few more questions like: ‘what’s your top tax bracket?’ etc. Soon after that we usually get a confession! They admit they have never really understood how they are being taxed.

But we tell them not to be embarrassed about it because very few people actually do know. Just like property investment, we aren’t taught it at school. But if you want to know how to get your tax back, you need to know how the Tax Office took it from you in the first place.

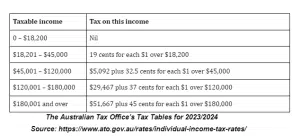

In Australia we have a ‘marginal tax system’. This basically means that the more you earn, the more you pay. At the time of writing the ATO website stated that those brackets were as follows:

The Australian Tax Office’s Tax Tables for 2023/2024

Source: https://www.ato.gov.au/rates/individual-income-tax-rates/

In simple terms, you are taxed as follows:

- 0% on your first $18,200 earned,

- 19% on your next $26,799 earned,

- 32.5% on your next $74,999 earned,

- 37% on your next $59,999 earned, and

- 45% on every dollar earned over that.

We are always amused by those people who say they ‘don’t want a pay rise because it will put them into the next tax bracket’. If you get a pay rise from $120,000 to $125,000, while you do move up a tax bracket, you’re not going to pay 37% tax on the whole lot. You’ll only pay 37% on the portion over $120,000.

Now that we understand this, join me next when I answer the question: “How does owning an investment property reduce your tax?”

~Daimien Patterson

👉Come and join our weekly webinars where we discuss strategies to improve your future, property investment tips and tricks, the do’s and don’ts of property investment and much more!