Gearing and Cash Flow🫸2

Do you know the difference?

Last time we covered Gearing. Today let’s look at cash flow – understanding the difference is key!

Cash Flow

When it comes to cash flow, it gets much simpler. It is quite literally the cash flowing in and out of your bank account. It includes your tax return and excludes your depreciation.

When you do your tax return, you take into consideration the theoretical depreciation of your investment property even though it is not real money. This means there is no real money entering or leaving your bank account for depreciation. Thus, your cash flow equation will look different to your tax time negative gearing equation.

If we look back at the previous example calculating tax, the negative gearing equation would look like this:

$28,600 (rental income)

– $30,517 (expenses/cash deductions)

= – $1,917 (negative gear)

Cash flow includes the actual tax return money you receive because that is real money coming into your bank account.

In our example, the cash flow equation would look like this:

$28,600 (rental income)

+ $7,123 (tax return)

– $30,517 (expenses/cash deductions)

= $5,206 (positive cash flow)

Negative Versus Positive

Understanding the dynamics of cash flow and gearing is pivotal in making informed investment decisions. Cash flow, in essence, is straightforward: a positive cash flow property results when more money enters your account than exits, while a negative cash flow property occurs when expenses outweigh income.

Gearing introduces a nuanced perspective. Negative gearing, often misunderstood, arises when a property is assessed with its expenses, including depreciation, against its income, primarily rental income. Despite appearing as a loss in this calculation, the property may still yield positive cash flow in reality.

Contrarily, a positively geared property is a rare gem, where the rental income exceeds all expenses, including depreciation. Such instances are scarce in Australia, typically achievable only with low debt against the property. In most cases, you might have a negatively geared property for tax assessment purposes but experience positive cash flow, as cash expenses remain lower than total income (rent and tax return).

In broader investment terms, gearing extends beyond real estate to shares and business ventures. Whether acquiring shares or seeking external funding for business growth, any investment requiring additional funds is considered geared. Understanding these nuances is key to navigating the intricate landscape of investment decisions.

Really makes you think!

☝️1 Building a property portfolio from scratch. Understanding the basics

Building a property portfolio from scratch is simple when you know how!

Step 1:

Before you have any properties to your name, the very first thing you need to do to start building your portfolio is to raise a deposit. There are many clever ways to get a deposit.

Option 1: Save, save, save!

While you can’t save your way to wealth, you can save your way to your first deposit. You only need to save enough for a deposit on your first property, thereafter you just keep leveraging from one property to the next to build your portfolio.

Option 2: First Home Owners Grants

You can make use of the FHOG.

Option 3: Get family help

Your family can help you in three different ways: gift, loan or family guarantee. If they are able, your family could give you the cash as a gift for a deposit. Alternatively, they can loan you the cash which you would pay back later. Now, they may not have the cash per se, but they could have equity in their own home from which they can borrow. Your parents would be able to go to the bank and take a $50,000 loan against their mortgage as a second loan. You would then make the repayments for the additional loan. Lastly, you have the family guarantee where you basically borrow 105% of the property value from the bank, where 100% is for the property and 5% is for the costs (stamp duty, legal fees, etc.) In this instance, the loan is worth more than the property and the bank is not happy about it so they want a guarantee from someone else, like mum and dad or your rich uncle, who will take responsibility for the loan repayments should you not be able to honour them for any reason.

You’ll then wait for the house to go up in value until it exceeds the value of the loan and go back to the bank and have them release the family guarantee since the property will be secured on its own value now. If you think you can’t afford a property right now, maybe you can with some family help.

Option 4: Workplace compensation payout

Have you ever been injured physically or mentally at work? And were you compensated for it? Often the hardest part of buying your first property is getting the deposit together. You may be one workplace compensation claim away from getting a decent deposit for one or several investment properties.

Most workplace compensation lawyers will give you a free consultation to review the feasibility and possible success of any claim. It’s definitely something to look into if you have a claim to make. If you are a serving or ex-member of the ADF, you may be eligible for DVA compensation.

✌️2 Two Steps to your property portfolio. Accumulate and leverage

Once you have your first deposit saved, you can go into the accumulation phase. You buy where it’s booming and leverage from one property to the next. Buy as much property as you can without over-committing yourself. Always make sure you have a positive cash flow after tax. This is critical if you want to keep moving forward.

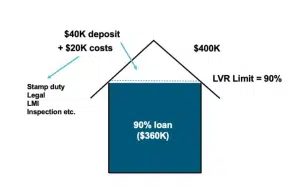

Let’s say, for example, you’re buying your first property with a value of $400,000 and a 90% loan of $360,000. However you’ve raised it, you put down a deposit of $40,000 plus $20,000 for costs (stamp duty, legals, LMI, inspection, etc.)

Figure 1: Breakdown of costs to buy a property

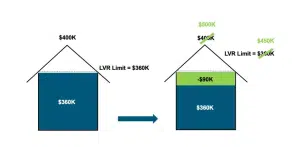

Once you’ve secured the first property you don’t need to save anymore. Well, you should be saving money on principle so that you’re not living beyond your means, but you won’t be saving money towards a property deposit anymore. What will happen instead is that the value of your property will increase and at the same time the amount of money you can borrow against it (your LVR limit) will increase too.

Figure: 2 Increase in property LVR limit

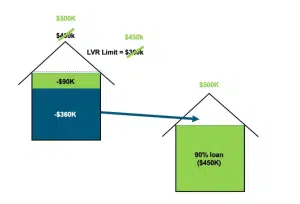

If the mortgage remains the same at $360,000 but the property’s value has increased to $500,000 then an LVR of 90% will take the limit up to $450,000. This means that there is available equity, that is, there is money you can pull out. You can take out a second loan of $90,000 against your first property and use it for a deposit on the next property.

Figure 3: Using existing property equity to purchase a new property

As you can see, the first deposit is the most difficult one to get. Thereafter, your investment properties do the work for you. You’re going to be on this earth for about 80-90 years, so if it means living like a pauper for just one year because you have no family support, then that’s what you need to do to get into this game. Your only aim is to get that first property.

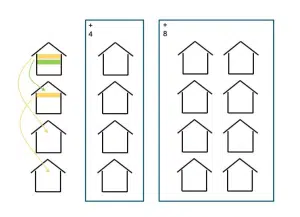

Then what will happen is a snowball – one property becomes two and two becomes four and so on. That is how you grow your “orchard” of apple trees and build your empire. It’s really that simple to start building and growing your investment property portfolio.

Figure 4: Growing a property portfolio

Many people want to get rich quickly, but this is not a get-rich-quick scheme. It’s a get-rich-slow scheme. In fact, it’s a ‘get very rich slow scheme’. Property investing can make you very wealthy. You simply need to start applying these principles and executing them. It’s your choice. Don’t be that person who is still spinning their wheels in 20 years, wishing you’d taken action today.

Stay tuned for more insights from Wealth Through Property.

~Daimien Patterson