How an investment property reduces your tax🤔.

Let us show you how!

I am excited to share this information with you on how an investment property reduces your tax!

Let’s put it into practice…

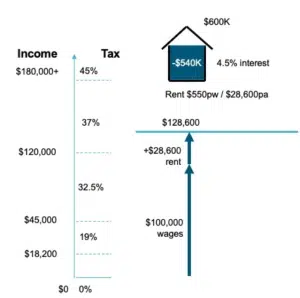

For this example, let’s say you earn $100,000 per year. Let’s also say you own an investment property worth $600,000 with a $540,000 mortgage. You rent the property for $550 per week (or $28,600 per year).

Firstly, the ATO will add the rent received to your income. This makes your income $100,000 + $28,600 = $128,600.

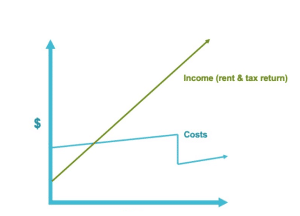

Figure 1: Income earned from wages and rent

At this stage if you had no deductions to subtract, you would be liable to pay tax on the extra $28,600 you received from rent. Fortunately, you will have plenty of deductions to cancel out the rent received and take your “on paper” taxable income below what you have already been taxed on.

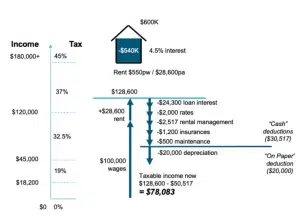

Now, let’s take a look at the other side of the coin: your deductions.

Deduction 1: Interest and bank fees

The first deduction is the interest and bank fees on your $540,000 loan. At 4.5% interest, the yearly interest would be $24,300.

Deduction 2: Rental management fees

The next deduction would be the management fees your rental manager charges. Let’s say they were taking a percentage of the rent and a letting fee (8.8%) to a total of $2,517.

Deduction 3: Insurance, rates, maintenance & miscellaneous

Next you have insurance at $1,200 (this would include building insurance and landlords’ insurance), rates at $2,000, and maintenance at $500. This gives you a total of $3,700.

These expenses are what we call ‘cash deductions’ as you use real cash to pay for them. These deductions come to a total of $30,517 per year.

Deduction 4: Depreciation

Finally, you have possibly the most important deduction: depreciation. This is what we call an ‘on-paper deduction’ since we are not spending real cash on it and the house didn’t actually go down in value. For this example, let’s use a round figure of $20,000. This is the secret sauce of property investment and why I always recommend buying a new property.

Let’s add up your total deductions:

$24,300 (interest & bank fees)

+ $2,517 (management fees)

+ $3,700 (insurance, rates, maintenance, etc.)

+ $20,000 (depreciation)

= $50,517

Whilst the rent increased your taxable income to $128,600, the $50,517 in deductions has brought your income back down to $78,083 on paper in the eyes of the tax office. As such, because you paid tax on your original salary of $100,000, and should have only paid tax on your taxable income of $78,083, you are due a refund!

Figure 2: Calculating new taxable income after deductions

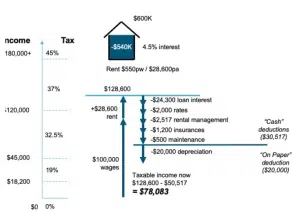

Going back to our tax tables, someone earning $78,083 would fall into the 32.5% tax bracket. Therefore, the total tax paid should be:

$5,092

plus 32.5 cents for each $1 over $45,000

= $5,092 + $0.325 * (78,083 – 45,000)

= $5,092 + $0.325 * (33,083)

= $15,844

Figure 3: Calculating your tax return

So if you paid $22,967 tax (on $100,000) and should have paid only $15,844 tax (on $78,083), the Tax Office owes you a $7,123 refund!

Now of course, I am not an accountant and the area of taxation is something that is constantly changing, so you should always speak to your accountant first before making any decisions on the basis of how they will benefit your tax situation.

Income versus expenses for your investment property will look like this:

$28,600 (rent)

+$7,123 (tax return)

= $35,723

– $30,517 (expenses)

= $5,206 (profit)

You’ll have a $5,206 profit for the year – that’s $100 of passive income per week. Remember this amount will also increase every year as the rent climbs. What could you buy with an extra $5,206 a year? You might take your family on holiday or lease a nice car.

What the wealthy understand is that you have two forms of income – your work income from your job and your passive income from your investment properties. You’ve got to respect your work income because you work hard for it. It’s precious and you don’t want to waste it. With that income you’re paying for necessities – putting a roof over your head, food on the table, keeping the lights on – and investing the rest.

Then your passive income is your fun money. It’s okay to spend it on fun stuff like flash cars and holidays since it will keep coming back again whether you work or not. This is what wealthy people teach their kids: buy real assets that build a passive income stream. That’s why they have flash cars and boats and take holidays four times a year. It’s very important to make this differentiation and respect your work income.

Breaking down the numbers.

Fundamentals of investment property cash flow.

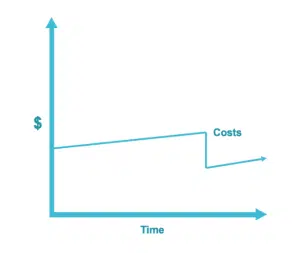

If you’re going to buy property, it’s important to understand the behaviour of a property’s cash flow over time. The cost of owning a property will naturally increase with inflation. Then there is a sudden drop when the mortgage gets paid out and it will cost a whole lot less to hold.

Costs of an investment property over time

Thankfully, the income you receive in the form of rent and a tax return from your investment property goes up far greater than inflation.

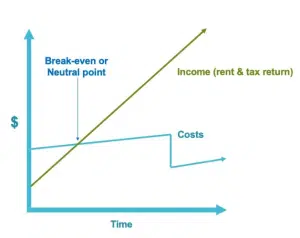

Income received vs. costs of an investment property over time

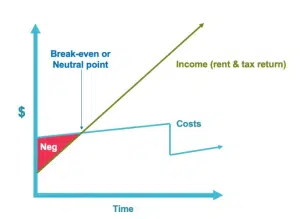

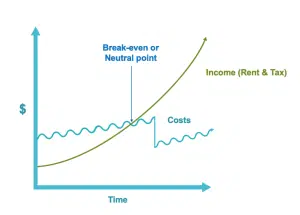

In the beginning, you may experience a negative cash flow until you reach the break-even point.

The break-even point of an investment property

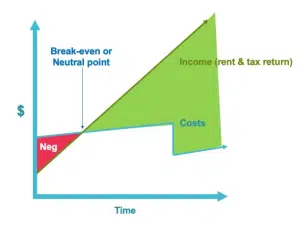

I call this negative space the ‘hurt locker’. Most properties start off in this negative space. If you have a property that is in the negative ‘hurt locker’, don’t fret! As time goes by, the rental income will eventually overtake the costs and get you into the positive. The good news about the ‘hurt locker’ is that it will come to an end.

Negative cash flow of an investment property, aka. the “hurt locker”

Here’s the beautiful thing: when you get into that positive cash flow, it goes off the scale! As you get older, you get richer. If you pay off your mortgage in the early stages of your retirement, your finances will just keep getting better.

Positive cash flow of an investment property

You can own an unlimited number of positive properties, but you can only own a limited number of negative ones before you run out of your own money to top them up. Remember that you can always make use of an interest-only loan to help offset the high expenses in the beginning.

One of the main reasons people fail in property investment is because they get too many negative properties and they sink themselves in the process. They end up having a bad experience and sell up.

It’s worth noting that these lines won’t actually be straight as depicted in the figures above. In reality, they will be wavy as inflation and costs fluctuate over time. But generally, over time the line of best fit will be straight as depicted. Your income is also more likely to be an exponential line as the suburbs increase in value over time.

Income received vs. costs of an investment property over time with fluctuations

Gearing and Cash Flow: Do you know the difference?

It’s important to understand that there is a difference between gearing and cash flow when it comes to investment properties. While cash flow is as simple as it sounds – real money flowing in and out of your bank account – gearing is slightly more complex.

Gearing

Gearing can mean two things:

- The effect at tax time when all expenses (including theoretical depreciation) are compared to all income and thus a tax return is deduced.

- In investment circles it can mean borrowing money from the bank in order to acquire a larger investment.

Gearing can be negative, positive or neutral. The meaning of negative gearing will depend on the context in which you’re talking about it. In the context of government policy, negative gearing is the term used to describe the policy that allows you to claim the expenses of an investment property, including depreciation, on your tax return. This reduces your taxable income and usually triggers a tax return. Since your taxes were originally calculated on your full salary and not your revised taxable income taking into account your deductions, you should get a refund on the tax paid on your original salary.

There has been much talk in Australia about removing negative gearing as a government policy or at least watering it down. However, they will never get rid of it entirely since the majority of politicians are in investment property, as well as approximately one in five Australian citizens. Removing negative gearing as a benefit would have several political ramifications for any political party that tried to do away with it.

From a finance and investment perspective, gearing refers to using the bank’s money to buy a bigger asset as an investment. In other words, if you only use your own money, you would have to buy a cheaper alternative. If you can borrow up to 90% of the purchase price from the bank, then you can invest in something 10 times more than what you could on your own. This is referred to as gearing as it makes your investment stronger. Much like riding a bicycle where your gears allow you to generate more power, borrowing money from the banks allows you to generate more investment power to acquire more assets.

Come back next time where we discuss cash flow!

~Daimien Patterson

JOIN OUR WEBINAR HERE

GET THE BOOK HERE