How to use Interest-Free Credit Cards

Understanding property finance 👉14

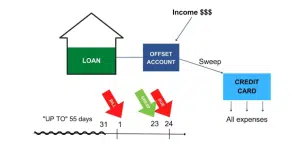

Another great tool you can use to control cash flow is an interest-free credit card. If used correctly in conjunction with your offset account, an interest-free credit card can help to save you money on interest charges. The idea is to put all of your spending onto the credit card for the month while your wages are sitting in your offset account reducing the interest on your mortgage. At the end of the interest-free period on your credit card, you withdraw the money from your offset account to perform a sweep of your credit card, settling the balance in full.

Most credit cards offer up to 55 days interest-free. The key term to acknowledge here is “up to” 55 days. Here’s how it works: let’s say there are 31 days in the month and you’ve used your credit card to pay for all your expenses instead of using your wages. You’ve put your wages directly into your offset account so that it can reduce the interest charges on your mortgage. On the first of the following month, the credit card company will issue a bill for the sum of all the month’s transactions and you’ll have until the 24th of the coming month to make the repayment. That’s 55 days from the first of the previous month.

Simply put, if you buy something on the first of the month, you have 55 days to pay it back. But if you purchase something on the last day of the month, you only have 24 days to pay it back so as to not incur interest charges. Hence, “up to 55 days” interest-free.

The day before the credit card bill is due (i.e. the 23rd of the month), you’ll perform a sweep to pay the credit card balance in full using money from your offset account. This guarantees that you never get charged interest on your credit card but also allows you to keep money in your offset account against your mortgage for a longer period of time.

This strategy will help you to pay off your mortgage even faster than in the previous example of adding an extra $100 a month to your principal payment.

Using an interest-free credit card with an offset account to control cash flow

You can take this technique one step further. Take a look at your bills, like your telephone bill for example, and you’ll often see that you’ll have 30 days to pay the bill. Are you going to pay the bill on the day you receive it or are you going to wait and pay it the day before it’s due?

You’ll want to wait for the due date and rather keep your money in your offset account as long as possible. Your money is better off reducing your interest than going straight out the door to the telephone company. This way you get a month out of the telephone company and a month out of the credit card company before you have to part with any real cash.

This is called a recurring LOC model and is a very good strategy that a lot of people use. They’re washing everything through their offset account and paying for as much as possible with their credit card. If you get the right kind of credit card this can also come with the added benefit of racking up a lot of frequent flyer miles which will give you a couple of free flights or upgrades per year.

If you don’t have a cash flow system like this in place yet, consider putting one together as soon as possible. Then pay your bills when they are due and no sooner!

Come back next for the final property finance insight.

Stay tuned for more daily insights from Wealth Through Property.

~Daimien Patterson

JOIN OUR WEBINAR HERE

GET THE BOOK HERE