Smart moves for homebuyers👏

Leveraging stamp duty concessions like a pro!

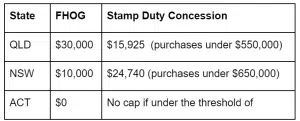

Stamp duty is a state government tax charged on the purchase of a property. It’s done on the day the title changes hands. If you’re purchasing a house and land package, the title changes hands on the day the land settles. This means you will only pay stamp duty on the land price – that’s an easy way to save money. If you’re buying an existing home or off the plan it will be calculated as a percentage of the full purchase price. Stamp duty concessions vary from state to state. Check your state government website for updated stamp duty values.

FHOG and stamp duty concessions by state/territory

I hope you found this information on how government assistance can be a game-changer in property investment helpful. Navigating the landscape of property investment becomes more strategic when you leverage the various avenues of support offered by the government. Whether it’s the First Home Owners Grant, stamp duty concessions, or other initiatives, understanding and utilising these resources can significantly impact your investment journey. If you have any further questions or would like to explore these opportunities in more detail, feel free to reach out. Here’s to your success in property investment!

How to grow a property portfolio. It is so easy when you know how!

Embarking on the journey of growing your property portfolio is an exciting endeavour, though, as with any venture, challenges may arise. The key is not to be discouraged but to approach these challenges with a strategic mindset. By understanding the intricacies of property investment and employing proven strategies, you can navigate potential obstacles and emerge with a successful property portfolio.

Understanding how investment properties work, managing cash flow and gearing, and adhering to the three golden rules are essential aspects of building a resilient property portfolio. These insights, when applied wisely, can contribute significantly to the long-term success of your investments.

Additionally, the decision of whether to rent or buy your home is a crucial consideration that influences your overall financial strategy. By carefully evaluating the pros and cons of each option, you can make an informed decision that aligns with your goals.

Remember, while challenges may surface, they also present opportunities for growth and learning. Your dedication to understanding the nuances of property investment positions you for success. If you have any questions or would like further guidance on any aspect, feel free to reach out.

How does tax work🤔 Introduction to investment property tax benefits

If you want to know how to get your tax back, you need to know how the Tax Office took it off you in the first place.

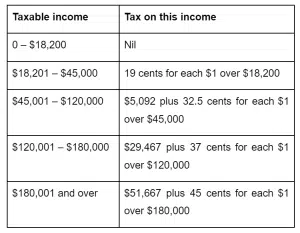

In Australia, we have a ‘marginal tax system’. This basically means that the more you earn, the more tax you pay. At the time of writing, the ATO website stated that those brackets for Australian residents in 2023/2024 were as follows:

Figure: The Australian Tax Office’s Tax Tables for 2023/2024

I am always amused by the people who say they ‘don’t want a pay rise because it will put them into the next tax bracket’. The good news is that it doesn’t work like that!

If you get a pay rise from $120,000 to $125,000, while you do move up a tax bracket, you’re not going to pay 37% tax on the whole lot. You’ll only pay 37% on the portion over $120,000.

The next thing to understand is that the rent you receive from a property actually increases your tax. On the other hand, all the expenses associated with holding the property, including the ever-so-valuable ‘depreciation’ are tax deductible, reducing your taxable income. This results in you getting a tax return.

Join me next when we put this into practice and see the results!

Stay tuned for more insights from Wealth Through Property.

~Daimien Patterson

JOIN OUR WEBINAR HERE

GET THE BOOK HERE