What would you do with $50K?

Understanding property finance 👉13

If you came into $50,000, what would you do with it?

Would you:

A) put it on your mortgage to pay the loan down; or

B) put it into an offset account against your mortgage?

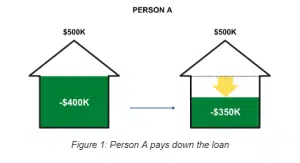

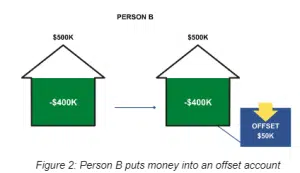

The majority of people will choose option A, even though it is not the best choice. Remember the middle-class dream? Most people choose option A because they believe they need to be mortgage-free. Now there isn’t much difference between these two options, but the small difference is what will help to boost your property investing success. Let’s compare: Person A and Person B each have a property worth $500,000 with mortgages of $400,000 when they come into an extra $50,000.

Person A puts the extra money onto their mortgage, decreasing the loan to $350,000.

Figure 1: Person A pays down the loan

Person B puts the money into an offset account instead, keeping their loan at $400,000.

Figure 2: Person B puts money into an offset account

From a net worth perspective, both individuals have the same amount of equity. The difference is in the type of equity. Person A has $50,000 more in assets and is therefore asset richer and cash poorer. Person B has $50,000 more in cash and is therefore cash richer and asset poorer. Either way, both individuals are paying less interest on their mortgage and have the same amount of equity. So, who has the advantage?

In this scenario, it’s Person B. Why? Because they have accessible cash in the bank. If an investment opportunity were to come along, they could act on it quickly. In contrast, if they were to lose their job, they have money available to use without needing to first request it from the bank. While you can always request to borrow money from your mortgage, the bank may decline you if you’ve lost your job since you won’t have an income to support the repayments. To go from bad to worse, they could even call in your mortgage as well if they become aware that you’re unemployed and can no longer service that original loan.

There’s a reason why people say ‘cash is king’. Cash is safer and more flexible, so you’re better off putting your surplus money into an offset account. It can still do the heavy lifting for you on your interest charges, but it’s easily accessible if you need it in a bind. Theoretically, you’re better off having a $400,000 mortgage with $400,000 in an offset account than paying off your $400,000 mortgage altogether and having no cash. Have I convinced you to use an offset account yet?

See you next time for the fourteenth property finance insight.

~Daimien Patterson

JOIN OUR WEBINAR HERE

GET THE BOOK HERE