Why Property WILL keep going up📈

Your questions answered!

In almost every capital city in Australia there are a few inner-city suburbs full of what they call ‘workers cottages’. These are small little dwellings usually squashed together. Have you ever wondered why they are called ‘workers cottages’? Well, it is because when they were built, ‘workers’ lived in them! (No offence intended to all the hard-working doctors, lawyers and business executives now living there).

You see, once upon a time, these areas were where the low-income battlers used to live. But as the population has grown, they have been pushed out. Now the increased numbers of high-income earners are competing for them and that’s why they are worth such incredible prices now.

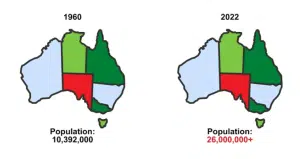

Below is a map of Australia in 1960 showing a population of 10,392,000, and a map of Australia showing the 2022 population of over 26,000,000. Can you notice what remains the same, and what has changed?

Figure 3.3 Land size vs. population growth in Australia, 1960-2022

The answer: Same amount of land – More people! It really is that simple.

It is all about supply and demand. It is an age-old phenomenon that has been around since the trading of the most basic commodities began. If something is in short supply people will pay more for it. As our population continues to grow, so will property prices.

Even during the Second World War, Australian house prices rose. During the ‘recession we had to have’ in the early 90s, house prices rose. The force of population growth is too great for any other countering force to ultimately

Unravelling the house price bubble debunking the myth!

You might hear some theories going around that Australia has a house price bubble that is set to burst at any moment. The most compelling argument for it is that the difference between the average wage and the average house price is now greater than ever before. While this sells a lot of newspapers and cites a factually correct situation (the difference between wages and house prices is indeed greater than ever) it ignores one key fact.

You see, about 30 years or so ago you could only get a 15-year mortgage. But now you can get a 30-year mortgage, and in many cases interest-free for a repeating period of 5 years as long as you have the means to service the interest. So now, on the same wage, you can borrow more money, and thus everyone can afford a relatively more expensive home than they could before. This is because they have longer to pay their loan back.

So the same repayment amount can service a greater amount of borrowings. As such everyone’s buying power has now increased dramatically, relative to their wage. So when they compete for the limited land and housing stock they are prepared to pay more.

Another theory is that we will experience a market crash similar to the ones that occurred in the United States and the United Kingdom. Now it is important to note that those crashes occurred in those countries due to the ‘GLOBAL’ Financial Crisis, but yet no price crash occurred here.

The short answer as to why this occurred is ‘irresponsible lending’ by banks in those countries. Their banks had such a huge supply of money to lend that they started lending it to anyone and everyone, including people who really couldn’t afford to pay it back.

When all those people started to foreclose on their mortgages at once, the market was flooded with houses for sale under mortgage foreclosure and supply then exceeded demand and prices dropped dramatically.

Why did that not happen in Australia? Because our boring old banks decided not to lend money to just anyone. We didn’t have a wave of foreclosures and our market stayed nice and stable. The true heroes that saved Australia from the Global Financial Crisis are actually our banks.

So you see there is no price bubble. Our banks simply do not lend money to people who cannot pay it back. Whilst we may beat up the banks a little bit, they at least deserve credit for that.

Property vs Shares. Why property is so awesome!

Ok then, so what about shares? Which is better, shares or property? Let’s say you have $100,000 to invest and examine our options ($100,000 is a nice round figure and easy on the math’s – don’t panic if you have less than that, there is still plenty you can do with a lot less).

Shares

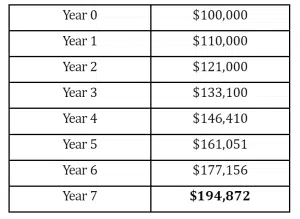

It is commonly accepted that the Australian stock exchange has historically returned an average of 10% per annum. So let’s see what happens if we buy $100,000 worth of shares and increase them by an assumed 10% every year for a modest seven years.

The table below shows the compounding growth.

Year 0

So in 7 years, $100,000 on the share market becomes $194,872. Not bad? Now let’s see what happens with property!

Property

Instead, let’s say we took our $100,000 and invested it in a property. If being conservative, we could invest in a $400,000 property using a 20% or $80,000 deposit, $20,000 for costs (stamp duty, legal fees, etc.) and borrowing the remaining 80% or $320,000 of the purchase price. So we would start with a $400,000 property and a $320,000 loan.

Now if the property market continues to do what it has done historically and the house doubles in value in 7 years, the property will be worth $800,000.

Now let’s assume the worst-case scenario and we don’t pay a red cent off the $320,000 loan. We simply just use the rent received from the property to cover the interest on the loan and other costs. $800,000 minus a $320,000 loan equals $480,000! So which would you prefer? The $194,872 from the share market with the daily stress of constantly watching your shares, or the $480,000 you make on an investment property? The choice is easy!

You see, the reason why property is so superior to shares is that you can safely borrow more money against it and leverage your way into a greater valued asset.

The above example is just being conservative with a 20% deposit on one property. What if, with your same $100,000 you purchased two $400,000 properties with 5% deposits of $20,000 each, and used $30,000 for the costs on each (you will need a bit more to pay mortgage insurance this time – but more on that later), and got 95% or $380,000 loans on each of them? You would start with $800,000 in assets and $760,000 in loans. But after 7 years you would end up with $1.6 million in assets. If you take away the $760,000 in loans you will have $840,000 in net worth!

Are you getting excited about property investment yet?

You can borrow money to buy shares but only up to about 60% of the value of the portfolio. But ask yourself – would you really want to do that? What an enormous risk! However, in property, the banks will lend you up to 95%! Why do you think that is? Let us tell you why. The banks know the safest and most effective place to invest money – it’s property!

High leverage and safety are why property investment is so awesome. The banks know it. We know it. And now YOU know it too.

Discover a fresh perspective on property investment with us next time, offering insights that will reshape your understanding of this dynamic market!

~Integrity Team

PSST – you can also register for our weekly webinars to learn all the tips and tricks that have changed the lives of regular Australians.