Calculating your borrowing capacity

Understanding property finance 👉15

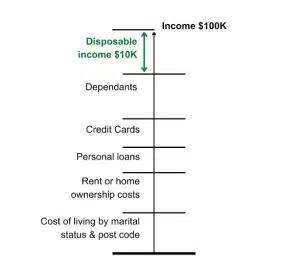

Borrowing capacity is defined as how much money you can afford to borrow based on your disposable income. This assessment is carried out by lenders and is calculated using your net income minus expenses. Your disposable income is what you have left after paying your bills.

The first thing lenders will do is subtract your cost of living based on your marital status, dependents and postal code. This amount is determined by the HEM expense estimate. Every lender has what is known as the Household Expenditure Measure (HEM) which is an estimate of your monthly living expenses. It is based on necessary costs such as food, utilities, transport, childcare costs and communication, while also taking into account discretionary spending for takeaway food, holidays, and entertainment.

Thereafter, they’ll look at additional expenses like your rent or mortgage repayments, any personal loans, car leases and credit cards. After all those things are taken care of, they take a look at the disposable income you have left. This is money you have available to service new debts and loan repayments. This amount determines your borrowing capacity.

Calculating borrowing capacity

As a very rough estimate, your borrowing capacity should be approximately 6 times your income. For example, if you earn $100,000 per year, your borrowing capacity would be around $600,000. This shortcut method becomes less accurate if you have existing loans.

What is important to note here is that even a slight reduction in your credit card limits or paying out a car loan significantly increases your borrowing capacity to buy property. However, every lender is different, so it is best to seek professional help from a qualified mortgage broker to find out your options.

Stay tuned for more daily insights from Wealth Through Property.

~Daimien Patterson

JOIN OUR WEBINAR HERE

GET THE BOOK HERE