First Home Owners Grant Why You Might Want To Avoid It For Your First Property

Are you eligible for a first home owner’s grant? If so, you’ll definitely want to read this blog.

So, what is the first home owner’s grant?

There are actually a few incentives that you might be eligible for. In Queensland, if you are buying a new house (valued at under $750,000) and are an Australian citizen, and you or your spouse have not previously owned property in Australia, you might be able to get $15,000-$20,000 (depending on the contract date) towards your purchase. In addition, you will have to live in this property for a minimum of 6 months to be eligible. You might also be eligible for a reduced stamp duty.

As a first-time property purchaser, you’re probably itching to go, keen to get into the market as soon as possible. One way you can do this is by using the government’s first home owner’s grant. In total, you could be looking at $30,000-$40,000 worth of benefits, which can go a long way to boosting your deposit and buying a property.

But before you do that, I urge you to look at your strategy and decide if now is really the best time, because the FHOG might actually end up costing you money in the long haul.

Allow me to explain…

It Forces You To Buy Locally

The problem with the grant, is that you will need to live in the property you buy with the grant for a minimum amount of time. This limits you to purchasing within your local area. And your local area might not be a good place to invest at the time.

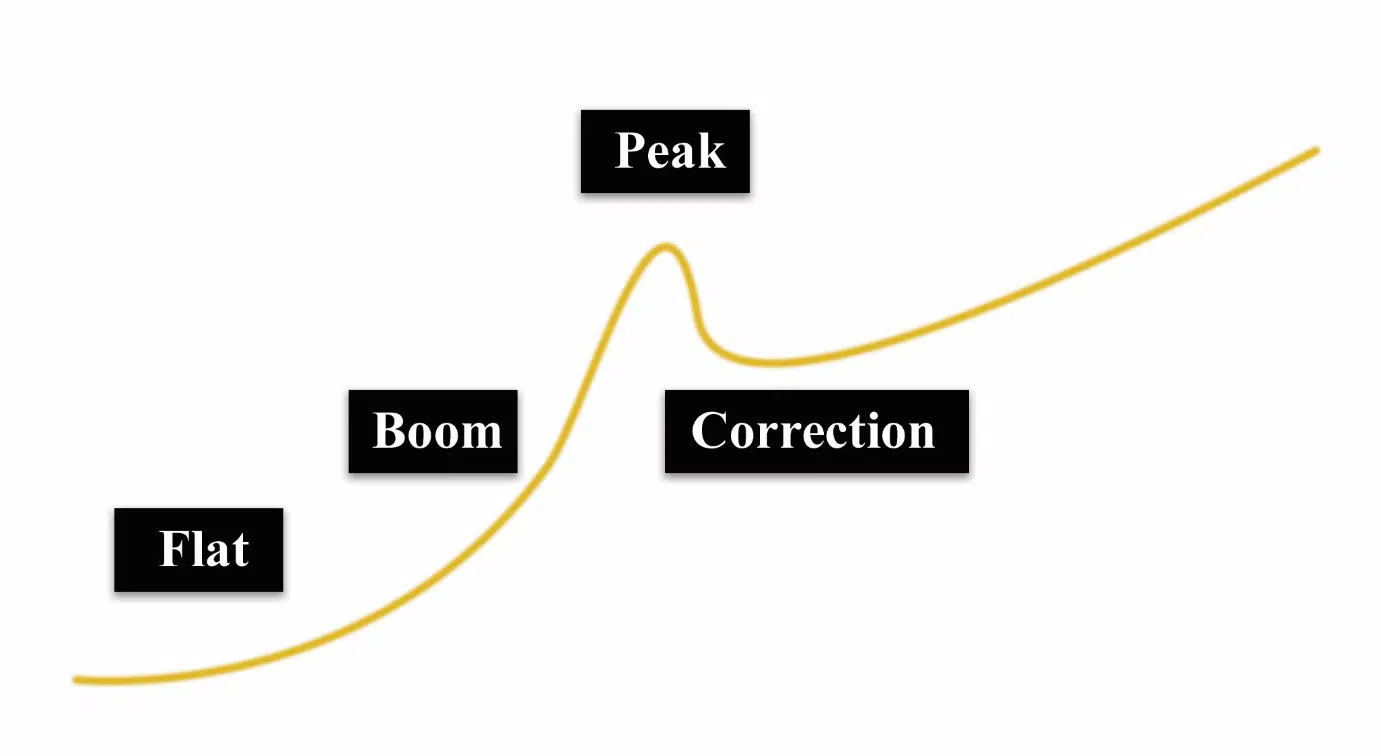

You see, every capital city in Australia is in a different stage of the market cycle.

What Is the Market Cycle?

The property markets all follow a cycle. It starts with a flat period where supply equals demand, which is then followed by a boom. Most booms last about 3-4 years, and then they peak, which is where prices reach the absolute maximum for the cycle. Next, the market has a correction where an oversupply comes on the market, and prices drop to boost sales. Once the supply levels out, the market goes back to another flat period, and the cycle starts all over again.

Buy Where It’s Booming

As I said, every capital city is at a different stage of this cycle. If you are planning to buy in your local area, you need to make sure that the cycle is in the right phase. Is it booming? Are you going to make money in the next couple of years so that your portfolio can continue to grow? Make sure you buy where it’s booming.

If you buy locally and it doesn’t boom, you might miss out on a significant amount of potential growth that you could have got from buying elsewhere. Your portfolio stagnates, and you’re stuck at one, when you could have got to two or three more properties in that same period if you’d bought in the right location.

If your local area isn’t booming, but you’re ready to get your first property, it might be better to take a slightly different approach.

Buy an Investment First, Use Your Grant Later

A smarter strategy that I see very few people employ might be this…

- Figure out where in Australia it’s booming

- Buy an investment property there and don’t live there or use your grant

- Wait for growth and available equity in that property (it shouldn’t take too long if you bought in the right location)

- Use that equity to purchase in your local area IF it is now booming (if not, keep investing elsewhere until it is)

- Use the first home owner’s grant on this property and then live in it for the minimum period

- Move out and rent your property out as an investment property*

* I’ll talk more in other blogs about why it’s smarter to rent your home and own investment properties instead of owning your own home.

Remember, if you want to do well financially, you need to think and act like the 1%, not the 99%. There is a reason why most people don’t even think to do this!

ADF or Ex ADF Member? CLICK HERE

Not an ADF Member? CLICK HERE

Happy property investing,

Daimien J Patterson