Hot spotting strategies.

Choosing the right location for investment.

Choosing the right location is the cornerstone of a successful property portfolio. This brings us to hot spotting, a strategic process of pinpointing areas with high growth potential.

Hot spotting is essentially foreseeing the future value of a location. To do this effectively, consider these key factors:

- Economic Drivers: Look for areas experiencing economic growth, driven by job creation and infrastructure development.

- Population Trends: Growing populations increase demand for housing, making an area more appealing for investment.

- Development Projects: Areas with planned infrastructure improvements often become prime investment spots.

- Market Trends: Analyse historical and current real estate trends to identify areas with consistent growth.

- Lifestyle and Amenities: Proximity to essential services and a desirable lifestyle enhances a location’s appeal.

Perfecting the timing

Timing is crucial in hot spotting. Stay informed about market cycles, interest rates, and external factors influencing your investment timing.

Mastering the commodity curve: Your keys to smart investment choices🔑

Using the commodity curve, let’s look at property as the commodity or product.

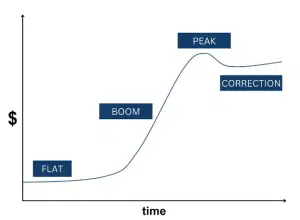

Figure: The commodity curve

Where on the commodity curve do you think it’s best to buy a property in a particular location?

My belief is that the best time is just after the boom starts. Often there is a lot of speculation about a boom coming, but then it’s only that – speculation. I prefer to see the boom actually start and then buy a property at that time in that location. That is the optimal time to buy.

It’s important that you realise though that buying a property at any time during the cycle is better than never buying a property at all. In addition, you need to understand that different cities are in different stages of the cycle at any given time. Whilst you might be thinking of buying a property in one city, you might actually be better off buying in a totally different city at that particular time.

If you buy a property at the peak of a boom and then experience a correction – do not worry! Eventually, the market will fix itself and you will make money in the long run. Property investing has the habit of making even the worst property investor look good, as long as they 1) actually buy a property and 2) hold onto it long-term.

Cracking the property code: Understanding property clocks🕜

The commodity curve can also be described as a clock. However, I think the property clock lacks sophistication and is too simplistic because it doesn’t explain how the cycle is driven by demand and value over time.

The property clock

The value of a commodity fluctuates over time based on supply and demand. When demand is equal to supply, you experience a flat period where nothing really changes. When demand starts increasing, you experience a boom until you reach a peak. After which a correction occurs, usually at a higher value than before the boom. That’s how you experience capital growth with property as your commodity. It’s why I’d rather look at commodity curves instead of property clocks because the curve demonstrates your capital growth in a clear, easy-to-understand way.

Stay tuned for more insights from Wealth Through Property.

~Daimien Patterson

JOIN OUR WEBINAR HERE