Let’s talk strategy, specifically portfolio growth… fast!

This is actually really important to know because the sooner you can go from one property to two, and two to four, and so on… the sooner you will have enough properties working for you to generate enough income to retire on (and do whatever else you want to do!).

Get a Deposit for Your First Property

The first step to growing your portfolio is to get your first property, and for that, you’ll need a deposit.

If I was starting from scratch, the first thing I’d do is go and ask a family member who has equity or cash for $50,000. But if I didn’t have anyone I could ask or who was willing, I’d get the money myself. I’d take one year and work a full-time day job and a part time night job, live on the cheapest food I could find, and save every cent I had until I had a deposit. Just for one year of your life, do what it takes to get on the field.

Buy Your First Property

Once you have your deposit, the next step is to buy your first property.

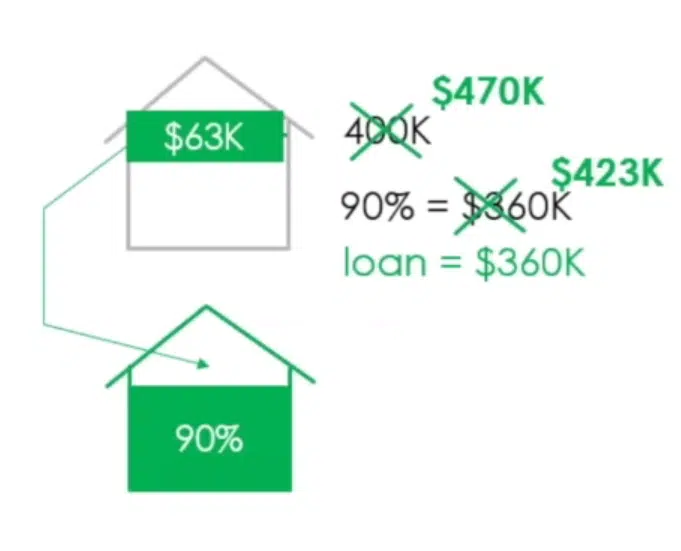

If it was me, I’d put a 10% deposit down and get a 90% interest-only loan.

I’ll talk more about what that property should look like in just a minute… but for the sake of this example, let’s call it a $400,000 property.

Now Buy Your Second Property

In time, your property’s going to go up in value. This will create available equity. So, now you’ve got what’s called available equity. If your $400,000 property goes up in value to $470,000, you’ve got $63,000 of available equity, because you can borrow up to 90%.

This means that you can purchase your second property. You go to your bank and get a second loan against your property for $63,000, which you use to cover the deposit and costs for a second property. The magic bit? You don’t need to use any cash of your own.

The remaining 90% of this property comes from another loan against the second property itself.

This is how property investors grow their portfolios!

How to Go FASTER!

But of course, this process isn’t enough to grow a portfolio quickly. If you want to speed things up, you need to pick the right property, especially early on in the game.

If you pick properties that are in booming locations, you’ll experience rapid growth from the boom, ensuring you get available equity sooner, and you can get into your next property even faster.

Here’s What My Mentor Did

You can start from scratch and build a massive portfolio using this strategy if you know what you’re doing.

One of my mentors got divorced at 30 and lost all five of his properties in the divorce. So he had to start from scratch. In the following 3 decades, he’d managed to acquire something like 75 properties.

He explained to me how this was possible, saying, “Daimo, you’ve got to understand, its exponential growth. One becomes two, two become four, four become eight. You don’t just put one on every year. In the early days, its slower, it might be three years between your first and your second property. But then it will be half the time to get to the third because you’ve got two properties working for you and they should be able to get the equity you need in half the time as a result. And as it goes, it gets bigger and bigger and bigger.”

He explained that two-thirds (so, 50) of those properties were put on in the last one-third of the time. That’s the power of exponential growth.

If you ever wonder how people afford to own entire apartment buildings and get into development and things like that, this is the process. These people have simply known this rule and been using these strategies longer than you have.

You’ve Got This

Want to be that person who owns 75 properties? You’ve got the knowledge now, so you can do this. All you have to do is execute.

Remember that the first step is to simply get the money and then get into your first property. Then get your second property. Make smart choices about what you buy and the process will go faster. And, of course, the longer you’re at it, the faster you’ll be able to accumulate properties. So, take that first step.

Daimien Patterson is the CEO of Integrity Investment Properties, a property investment company based in Australia. He regularly produces books, blogs, and videos on the topic of property investing. Head to [integrityinvestmentproperties.com.au] for your free copy of Daimien’s book, Safe as Houses.