Investment Properties Simplified. How investment properties really work

Join us for our next blog series “Mastering the Property Game: Your Blueprint for Success!”

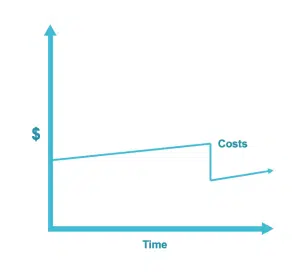

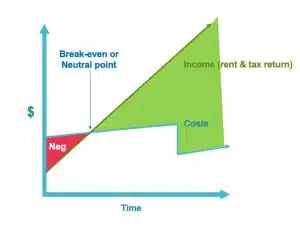

Over time, the cost of owning a property will naturally increase with inflation. Then there is a sudden drop when the mortgage gets paid out and it will cost a whole lot less to hold.

Figure 1. Costs of an investment property over time

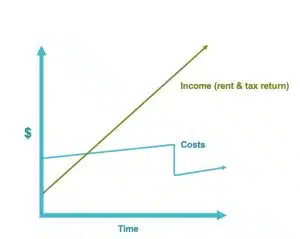

Thankfully, the income you receive in the form of rent and a tax return from your investment property goes up far greater than inflation.

Figure 2. Income received from an investment property over time

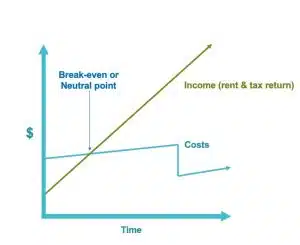

In the beginning, you may experience a negative cash flow until you reach the break even point.

Figure 3. The break-even point of an investment property

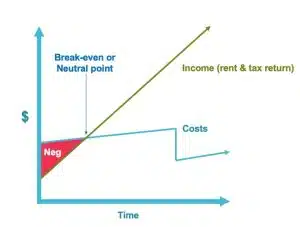

I call this negative space the ‘hurt locker’. If you have a property that is in the negative ‘hurt locker’, don’t fret! As time goes by, the rental income will eventually overtake the costs and get you into the positive. The good news about the ‘hurt locker’ is that it will come to an end.

Figure 4. Negative cash flow of an investment property, aka. the “hurt locker”

Here’s the beautiful thing: when you get into that positive cash flow, it goes off the scale! As you get older, you get richer. If you pay off your mortgage in the early stages of your retirement, your finances will just keep getting better.

Figure 5. Positive cash flow of an investment property

Next we take a closer look at “Understanding Wealth Creation”.

~Integrity Team

🫵Come and join our weekly webinars where we discuss strategies to improve your future, property investment tips and tricks, the do’s and don’ts of property investment and much more!

JOIN OUR WEBINAR HERE