It’s not your fault!

You are just a product of your upbringing.

Believe it or not, there are 25-year-olds out there who have already made their first million dollars, and many of them through property investment. Doesn’t that make you mad? We know what you’re thinking – they must have just got lucky, or they must be way smarter than you will ever be. Rubbish! Property investment is easy if you know what you are doing and anyone can do it. Even if you have no money. The problem is that they don’t teach you how to do it in school. Someone else has to teach you. If those 25-year-olds with a million dollars are lucky, it’s only because someone took the time to teach them about property early in their life.

Property investment knowledge is one of the greatest gifts you can give someone. It gives us a great thrill to know that we have helped thousands of people simply by writing this book and passing on some of that knowledge. So it’s not actually your fault. It’s just that no one bothered to teach you about it. No point in hating the world for it!

Now you know the problem, just get on with fixing it. The first step is to just keep reading these blogs. The fact that we get our financial education from our parents and close family, is one of the main reasons why the ‘rich get rich and the poor stay poor’. The rich parents teach their kids how to make money, and the poor parents teach their kids how not to. If you want to break free of that situation, you need to realise this and start looking for your financial education elsewhere. In simple terms, if you want to end up like your parents financially, just do what they did! Chances are they would tell you to try and pay your house off the good old-fashioned way, ‘25 years of hard slog and maybe a holiday after that’.

Let us assure you there are plenty of smarter ways to build wealth and end up debt free. But more on that later.

It’s time to get real with yourself 🤔

Let’s get real for a moment! The truth is that we spend half our life buying things to impress people we don’t even like. The aged pension, or our superannuation, is not going to be anywhere near enough to live on and we’re all going to live a lot longer than our previous generations did. Life expectancy is getting longer with every generation.

How are you going to earn an income in retirement? Even worse, what if you had an accident next week and were forced into an early form of retirement because you were no longer able to work? How would you and your family survive financially? If you are not already, you should be taking this stuff very seriously.

There are thousands of rags-to-riches stories of people who made a decision to succeed financially, got their act together, and achieved it. It has nothing to do with how smart you are, or how much money you have now. It is simply a decision you have to make, a decision to take action TODAY. Not putting it off until next week or sometime in the future. It’s about saying ‘Enough is enough; I am going to sort this out once and for all, and I am going to start today’. Are you ready?

The truth about property. What the media doesn’t tell you

There are many doomsayers on property who are quick to say the sky’s going to fall in, but when you look at the facts it is extremely hard to argue as to why you should bother investing in anything else. Property just keeps on going up for the same reasons it always has and always will. More people, same land.

Historical Data

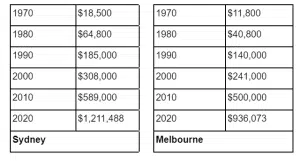

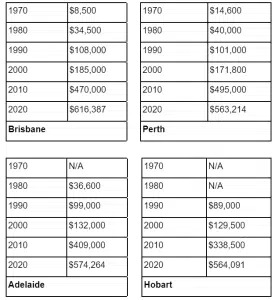

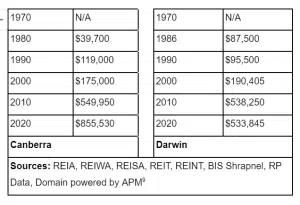

Imagine that it’s 1980 and your house just rose 400% from $8,000 to $32,000 in the last 10 years, and we say to you “Whatever you do, don’t sell this house – because in 10 years from now, it will be worth 300% more again”. You would have said we were mad! Well, that actually happened! As long as the population increases, property prices will go up. So what are the facts? Below are the historical median house prices for the Australian major cities for 40 years between 1970 and 2020. In the decade between 2000 to 2010 every city, except Sydney and Hobart which only just missed out, more than doubled in value. And Sydney and Melbourne have rocketed off again in the last two years. If you want a real thrill, look at what happened in the 1970s and 1980s!

Figure 3.1 Historical house prices in Australia.

From 2000-2020, Brisbane values increased by 254%! The average increase each decade for the last 40 years in Brisbane has been an astonishing 285% every ten years! And that’s in price alone. That doesn’t take into consideration the fact that the return on investment (ROI) is much higher if you consider that the investor has only committed a deposit, some transaction costs and perhaps some holding costs, and used the bank’s money for the rest. The effect of borrowing money to leverage the result is amazing!

For example; let’s say you purchased a house in Brisbane in 2000 for $185,000. If you used a 10% deposit of $18,500 plus a budget of $15,000 to cover stamp duty and other costs, your contribution would have been $33,500. Now let’s say you got a loan from the bank of $166,500 to cover the remaining 90% of the purchase price. In 2010 your property would have been worth $470,000, and if worst-case you had only paid the interest on the loan and you still owed the full $166,500, you would have made $303,500 ($470,000 – $166,500). So you will have turned your initial investment of $33,500 into $303,500 in 10 years. That’s a 904% return over ten years! Or 24.6% per annum compounding.

But will prices keep going up, you say? Will history continue to repeat itself? Well if all things happen for a reason, and those reasons (like population growth and limited supply of land) continue to persist, why wouldn’t prices continue to rise?

~Integrity Team

PSST – you can also register for our weekly webinars to learn all the tips and tricks that have changed the life of regular Australian then: JOIN OUR WEBINAR HERE