The great housing debate.

To rent or to buy?

Believe it or not, you are better off financially renting your own home and buying investment properties, rather than buying your own home. Buying your own home is a ‘lifestyle decision’ and will cost you more than buying an investment property.

Here’s an example of why this is true:

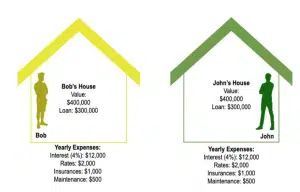

Let’s say Bob and John own identical houses side by side each worth $400,000. They both have a mortgage of $300,000. They both pay the same rates, insurance, etc. Everything is identical for the sake of this exercise.

Figure 1: Bob and John each own their own house

Then one day someone suggests that they swap houses and rent from one another. How will their situation change?

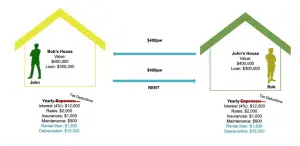

John will pay Bob $400 per week in rent and Bob will pay John $400 per week in rent. In essence, the cost of renting that they each incur will be cancelled out by the rent that they each receive. They both still own one property worth $400,000. If the market goes up by 10% they still make the same money. They both still have a $300,000 mortgage and they have the same rates and other bills to pay.

Figure 2: Bob and John switch houses and rent from each other

But… now the property they each own is considered an ‘investment property’. The key difference is the government allows them to claim all their expenses on tax. All the mortgage interest, all the rates and insurance bills, maintenance costs, everything! The yearly expenses are now considered tax deductions and they will get a big tax return every year. This is called “rent-vesting”.

From a purely financial perspective, your default should be to rent where you need to live, and buy where you will make money. Even better, if you’re in the Defence Force and you get half-price rent then you should definitely be renting. We are not saying that buying your own home is ‘wrong’. It is just important that you recognise that it is a lifestyle decision and not a financial one.

If you have limited money to invest, you can actually get into the market sooner this way. You are no longer constrained to buy where you are living and your buying criteria can be purely focused on investment reasons. As such you will make exponentially more money because you will be able to buy where the property market is booming. There is always somewhere in Australia that is booming. If your criteria is purely investment-driven, then every time you buy a property it can be in a boom location.

Refinancing your property? Strategies that shape cash flow

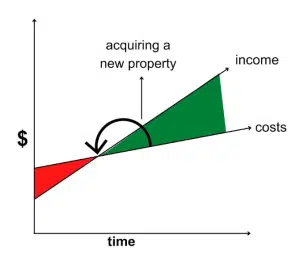

You will reach a point where your rental income will be higher than your expenses. You could be $100-$200 a week profitable and have some equity in your property. This is a great time to go and acquire a new investment property!

You can draw money (or equity) from your existing property. Say, for example, you draw a $100,000 loan from your property to use as a deposit and to cover the costs of acquiring a new investment property. What you are actually doing here is pushing up your expenses since the new property will add a new mortgage repayment to your expenses. That will consume the extra rent you were making from your first investment property.

Figure 1: The effects of refinancing on cash flow

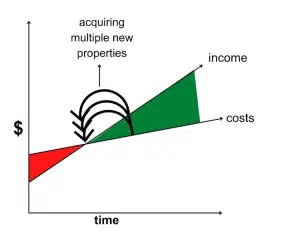

This cycle continues as you accumulate more properties to grow your portfolio. What happens is you get profitable, and then you consume the profit to go into more debt to pay for more properties. Whenever you get the $200 positive mark (where your rent is higher than expenses), you go out and get another property and return back to a break-even point. You continue this cycle of getting profitable and returning to a break-even point over and over again as you buy more properties.

Figure 2: The effects of refinancing on cash flow with multiple properties

This is important in the accumulation phase (which we’ll discuss next) to increase your capital growth while you are still working a regular job. During this phase, you’re constantly reinvesting all the cash flow back into more properties because you don’t need to live off that income while you are working. During retirement, capital growth becomes less important and you become more focused on the passive income that your properties make for you.

This process can be a dilemma for many property investors, but in a way, the banks will eventually force you to do it when you hit your borrowing capacity. They won’t lend you more money, so you’ll need to pay down what you’ve got in order to free up some equity to continue acquiring property. To get around this, some people might choose to leave their jobs to go into business for themselves in order to make more money to fund their property investing journey.

4 phases of property investment. Your roadmap to real estate success

There are four phases of property investing and most people go through them without even realising it. Being conscious of what stage you are in can help with your goal-setting and planning ahead.

The four phases are:

- Save, Save, Save

- Accumulate,

- Consolidate, and

- Financial Freedom / Retirement.

If you read the below descriptions of each, you should be able to easily tell which phase you are in currently.

Figure: The four phases of property investing

During the accumulation phase, you will get to a point where you have surplus value in your properties with increased equity and increased rent. This enables you to accumulate more properties as time passes, to eventually build your portfolio as large as you possibly can. The goal in this phase is not to make passive income because all that extra cash should be covering repayments on the mortgage of your next property.

It is safe to say that everyone wants to retire someday and live off of a passive income. That’s why it’s important to understand the consolidation and retirement phases. When you are almost ready to retire (depending on the markets that could be about five years), you need to start consolidating. During this phase, you need to stop buying property and allow your portfolio to slide into a surplus rent situation, building your passive income source.

Additionally, you could also sell a couple of your properties to release the equity and pay down your remaining loans. This removes a major expense involved with holding onto your portfolio drastically increasing your passive income from your remaining properties.

The final phase is your retirement where you can live off of the surplus rent you receive. It’s a time to have fun and remind all your friends why they should have started the property portfolios earlier. Your rents will continue to grow with time and as such so will your passive and disposable income. There is a possibility that you might want to go back and buy more properties during your retirement and there’s absolutely nothing wrong with that.

Stay tuned for more insights from Wealth Through Property.

~Daimien Patterson

JOIN OUR WEBINAR HERE

GET THE BOOK HERE

#SmartPropertyInvesting #FinancialSuccessJourney #WealthBuildingBasic