Should I Use My Super to Buy an Investment Property

Property investing through superannuation has been a bit of a hot topic these last few years in the Australian real estate community. So…

Should you buy property through your superannuation?

First, a disclaimer. Australian legislation prevents me from providing superannuation advice. For official advice, you need to talk to a licenced financial planner, advisor, or a superannuation accountant. Anything I say here is just general information and you must go and talk with someone qualified who knows your individual situation and can comply with regulations.

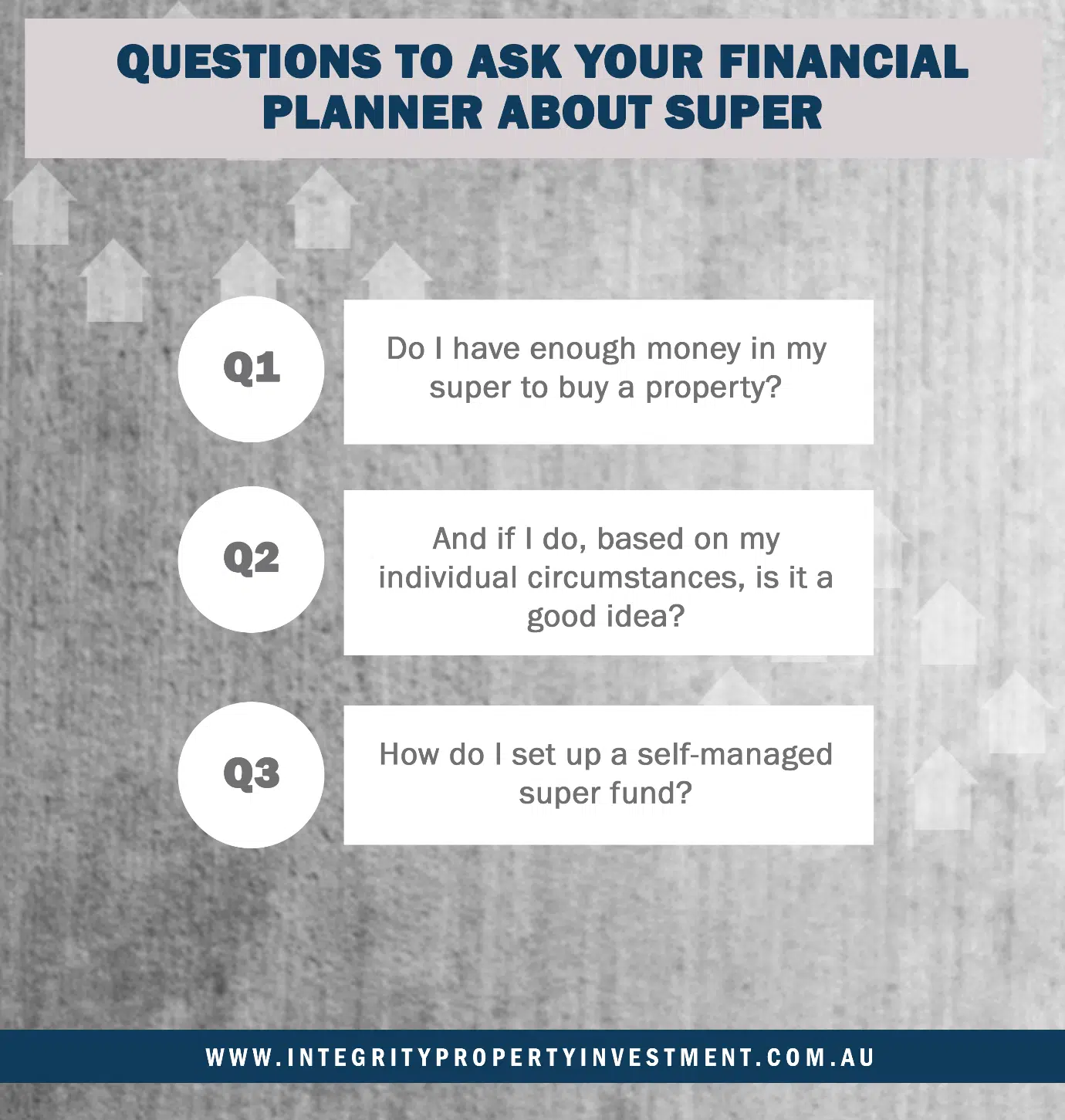

Some questions you should ask them are:

- Do I have enough money in my super to buy a property?

- And if I do, based on my individual circumstances, is it a good idea?

- How do I set up a self-managed super fund?

Benefits of Buying Property through Super

Here are some of the reasons property investors might like to consider buying property through super:

- You can have up to four beneficiaries of a super fund

- A husband and wife can pool their funds together to buy a property

- It could give you more control over the growth of your super

- Property may offer a better strategy than leaving your money in shares

Potential Disadvantages to Consider

- Lending is capped at about 70-80%

- You’ll need to invest more conservatively

- You’ll need to consider the personal insurances that are part of super

- You’ll need a minimum amount of super (about $200,000) before this become a worthwhile strategy

- There are rules to consider – you and your family members cannot live in the property, as it is strictly for investment

- There are fees involved in managing and administering your self-managed super fund.

At the end of the day, your circumstances will vary, so you do need to go and see a financial planner. But I encourage you to seek a good one who understands property (some financial advisors are very quick to steer investors away from property).

If you want a good, balanced financial planner, get in contact with me so that I can put you in touch.

ADF or Ex ADF Member? CLICK HERE

Not an ADF Member? CLICK HERE

Happy property investing,

Daimien J Patterson